Silver has been a valuable commodity for centuries, with its worth being determined by its purity, weight, and rarity. The Cologne Mark, a unit of weight equivalent to 233.856 grams, was used as the base unit for several currencies, including the Lübeck monetary system and the coinage systems of the Holy Roman Empire. Silver's value is influenced by global supply and demand, market conditions, and geopolitical events. Additionally, the metal's content and purity play a significant role in determining its worth. Hallmarks on silver items indicate their purity, place of assay, manufacturer, and year of assay. Silver has also been used as a form of currency and a store of wealth during periods of hyperinflation. Today, silver is traded on global exchanges and its spot price is influenced by various macroeconomic factors, market sentiment, and industry-specific dynamics.

What You'll Learn

Silver hallmarks and their meanings

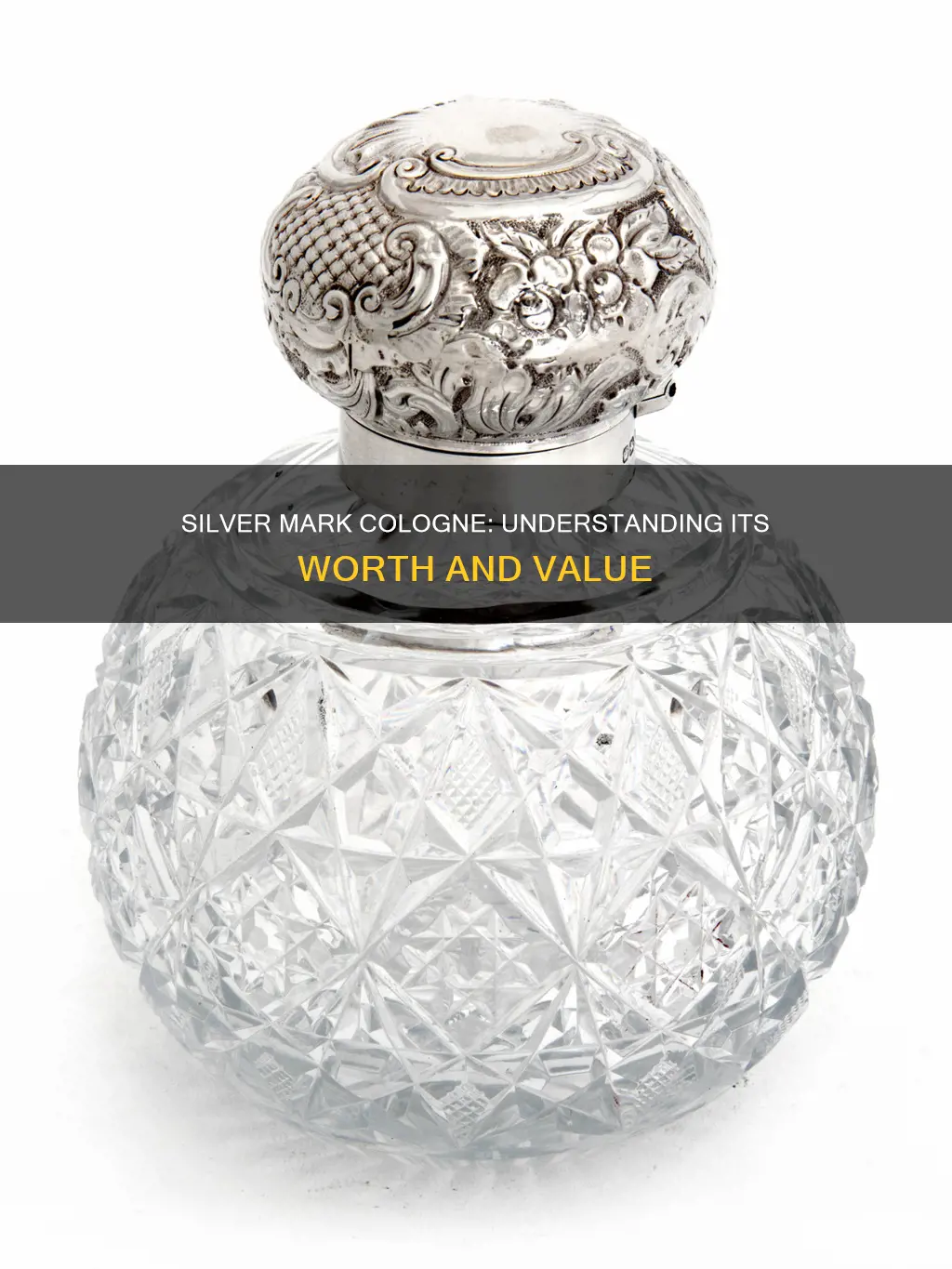

Silver hallmarks are an important factor in identifying antique silver items. These small stamped symbols on the back or underside of silver items can tell you about the purity of the silver, the manufacturer of the piece, and sometimes even the date and place it was made.

Purity of Silver

The hallmark for sterling silver varies from nation to nation, often using distinctive historic symbols. The mark for silver meeting the sterling standard of purity in the UK and Ireland is the Lion Passant, denoting 925 parts per thousand silver. The Britannia standard, denoting 958 parts per thousand silver, was obligatory in Britain between 1697 and 1720. The Britannia standard is now denoted by the millesimal fineness hallmark "958", with the symbol of Britannia being applied optionally. The French have two standards for silver purity: the higher 1st Standard, 950 parts per thousand silver, and the lower grade 2nd Standard, 800 parts per thousand silver. In the United States, sterling silver is defined as 92.5% pure silver.

Manufacturer of the Piece

Each silver maker has their own unique maker's mark, usually a set of initials inside an escutcheon. In many cases, silver manufacturers also stamped their wares with a symbol or logo.

Date and Place of Manufacture

The date mark is usually a letter indicating the exact year in which the piece was made. The typeface, whether the letter is uppercase or lowercase, and the shape inside which the letter is stamped, must all be considered to determine the year. The city mark indicates the city in which the piece was assayed. For example, Birmingham is indicated by an anchor, Chester by three wheat sheaves and a sword, and Sheffield by a crown.

Special Hallmarks

Special temporary hallmarks are sometimes adopted to commemorate special events and anniversaries. For example, British Assay Offices used commemorative marks in 1935 for the Silver Jubilee of King George V, in 1953 for the Coronation of Queen Elizabeth II, and in 1977 for the Silver Jubilee of Queen Elizabeth II.

Cologne Conservation: Making 2 Oz Last

You may want to see also

Silver's value and what affects it

Silvers value and what affects it

Silver is a precious metal that has always been in demand due to its unique characteristics and relative scarcity. Its value is influenced by a variety of factors, including economic trends, market dynamics, and industry demand. Here are some key points that affect silver's value:

- Supply and Demand: The law of supply and demand applies to silver as well. When the supply of silver decreases due to factors like mining interruptions or increased industrial use, the demand and price of silver increase. Conversely, when there is an abundance of supply, the price per ounce tends to decrease.

- Economic Trends: Silver is often seen as a safe haven investment during economic uncertainty. In challenging economic times, investors may turn to precious metals like silver, increasing their demand and value. Conversely, a strong and vibrant economy may reduce investment demand for silver, even if industrial and jewelry applications still require it.

- Strength of the US Dollar: The value of silver usually has an inverse relationship with the strength of the US dollar. When the dollar weakens, the price of silver tends to increase, as it becomes more affordable for investors using other currencies. A strong dollar, on the other hand, can make silver more expensive for foreign investors, leading to a decrease in demand and a potential drop in price.

- Industrial Demand: Silver is highly valued in industrial applications due to its softness, malleability, ductility, and excellent electrical and thermal conductivity. As a result, it is widely used in advanced technologies, such as 5G wireless and photovoltaic cells (solar panels). The demand from these industries can significantly influence silver's value.

- Inflation: Silver is considered a hedge against inflation. As inflation erodes the value of paper currency, investors turn to precious metals like silver to protect their wealth. Therefore, during inflationary periods, the demand for silver increases, driving up its value.

- Government Policies: Government actions and policies can also impact silver's value. Central banks' decisions to buy or sell silver bullion and the production of coinage by institutions like the US Mint influence the supply and demand dynamics of silver. Additionally, policies that promote strong production rates in various sectors can strengthen the currency, reducing the appeal of precious metals like silver as an investment.

- Technological Advancements: Technology plays a dual role in the value of silver. On the one hand, new technologies may reduce the demand for silver in certain applications, such as the use of aluminum alloys in cheap mirrors. On the other hand, advancements in green technologies and solar energy systems create new demands for silver, making technology a net bullish factor for silver prices.

- Investment Portfolio Diversification: Silver is often sought by investors as a way to diversify their portfolios and hedge against potential losses in traditional investments. This demand for silver as a safe haven asset can drive up its value.

These factors, among others, contribute to the complex dynamics that influence silver's value. Understanding these variables can help investors make informed decisions about buying, selling, or holding on to their silver assets.

Crafting Scentsational Sentences: Cologne's Captivating Role

You may want to see also

Silver bullion and its availability

Silver is one of the most popular precious metals to invest in due to its availability, affordability, and the unique options it offers. Silver is available in coins, bars, rounds, statues, shot, bullets, and more.

The most popular form of silver on the market today is silver coins. These coins have their purity, weight, and metal backed by a central government. Some of the most popular options include:

- American Eagle Silver Coins

- Australian Kangaroo Silver Coins

- Austrian Philharmonic Silver Coins

- British Britannia Silver Coins

- Canadian Maple Leaf Silver Coins

- Chinese Panda Silver Coins

- Mexican Libertad Silver Coins

- South African Krugerrand Silver Coins

Silver bars are simpler in design but are more readily available due to the unique sizes they come in. Silver bars remain a top choice for investors and collectors due to these weight options, parlayed with their high purity. Some popular silver bar producers include:

- Asahi

- Geiger

- Perth Mint

- SilverTowne

- Sunshine Minting

Silver rounds are available primarily from private mints in the United States and around the world. While silver rounds and silver coins have a lot of visual similarities, silver rounds do not have a face value, are not struck by sovereign mints, and do not hold legal tender status. This allows for unlimited mintages to meet the demand for silver among investors and collectors. Some popular options for silver rounds include:

- JM Bullion 1 oz Silver Round

- Sunshine Silver Round

- Fractional Silver Rounds

Silver is a quiet hero that many investors turn to for diversity and affordability. With its availability in various forms, silver is a great option for anyone looking to diversify their precious metal portfolio.

Colognes: A Burning Solution to Prevent Injuries

You may want to see also

Silver's weight and its impact on value

Silvers weight and its impact on value:

Silver is a precious metal that has been valued for thousands of years. Its value is influenced by its weight, purity, and the industrial demand for its practical applications. The weight of silver is a critical factor in determining its worth. The standard unit for measuring silver weight is the troy ounce, which is approximately 31.1035 grams. The value of silver is typically quoted in US dollars per troy ounce.

The weight of silver impacts its value because the metal is often traded in bullion bars, coins, or other standardised forms. The larger the weight of these standardised forms, the higher the value. For example, silver bars tend to be cheaper per ounce the heavier they are. Additionally, the weight of silver jewellery or tableware influences its price.

Silver's value is also determined by its purity. Silver bullion, for instance, is typically either .999 or .9999 fine silver, meaning it is 99.9% or 99.99% pure silver, respectively. The higher the purity, the higher the value of the silver.

The industrial demand for silver also affects its value. Silver has exceptional electrical conductivity, making it highly sought-after in the electronics industry. As the demand for electronic devices increases, so does the demand for silver, driving up its price. Additionally, silver is used in solar panels, further increasing its value as the world transitions to renewable energy sources.

Silver's weight plays a crucial role in determining its value, but other factors such as purity and industrial demand also come into play. The interplay between these factors makes silver a dynamic asset that responds to shifts in the global demand landscape.

Exploring the Number of Squirts in an Ounce of Cologne

You may want to see also

Silver plate and its value

Silver plate is a type of houseware made from base metal and plated with a thin coating of silver. It has the look and feel of sterling silver but costs a fraction of the price. The silver plating process was invented in 1742 by Thomas Boulsover, who introduced old Sheffield plate. Silver plating protects the underlying metal from corrosion or oxidation, increasing its longevity.

The value of silver-plated antiques can range from a few dollars to hundreds or even thousands of dollars in rare instances. Generally, the value depends on the age and condition of the piece, as well as factors such as the maker, design, and decoration. For example, a good-quality example of silver plate made around 1840 can be worth between $5 and $500, depending on its condition and rarity.

The scrap value of silver plate is typically low because it contains only a thin layer of silver over a base metal, making its silver content minimal. Sterling silver antiques are generally worth significantly more—both in scrap value and resale value.

Silver plate has its own codes and symbols used by manufacturers to designate silver plating and solid lower-grade alloys. The maker or company name is usually stamped on the back of the piece, along with an indication that it is plated. In America, these marks are A1, AA, EP, or the full phrases "sterling inlaid" or "silver soldered." According to industry standards, AA has one-third as much silver used in plating as A1 pieces.

If you want to determine the value of an antique silver tray, there are a few steps you can take:

- Identify the type of silver tray: Silver trays can range from silver plate to sterling silver. The type of silver will affect its value.

- Determine the maker of the tray: The maker of the tray can also impact its value. If the tray was made by a well-known silversmith, it will likely have a higher value than one made by an unknown maker. Look for a maker's mark or hallmark.

- Inspect the tray for damage: Check the silver tray for any signs of damage, such as scratches, dents, or tarnish, as these can reduce the value of the tray.

- Consider the age of the tray: Older trays tend to be more valuable than newer ones. You can use the maker's mark and other clues to help determine the age.

- Research the market value: Once you know the type of silver, the maker, and the age of the tray, you can research the current market value of similar trays by looking for comparable trays for sale online or in antique shops.

- Get an appraisal: If you still can't determine the value, you may want to get the tray professionally appraised to get an accurate estimate.

Exploring the Ideal Number of Colognes for Your Collection

You may want to see also